In today’s digital banking age, Know Your Customer (KYC) is not just a regulatory requirement it’s a vital tool to ensure the security and legitimacy of your financial transactions. Whether you’re a student, working professional, or retired individual, updating your KYC details ensures uninterrupted access to your banking services. A simple application for KYC update in bank can prevent future hassles like transaction freezes or blocked accounts.

If you’re unsure how to draft the right application or wondering what format to follow, this guide will walk you through everything, including a downloadable format, examples, and tips for different banks like SBI and Canara Bank.

Table of Contents

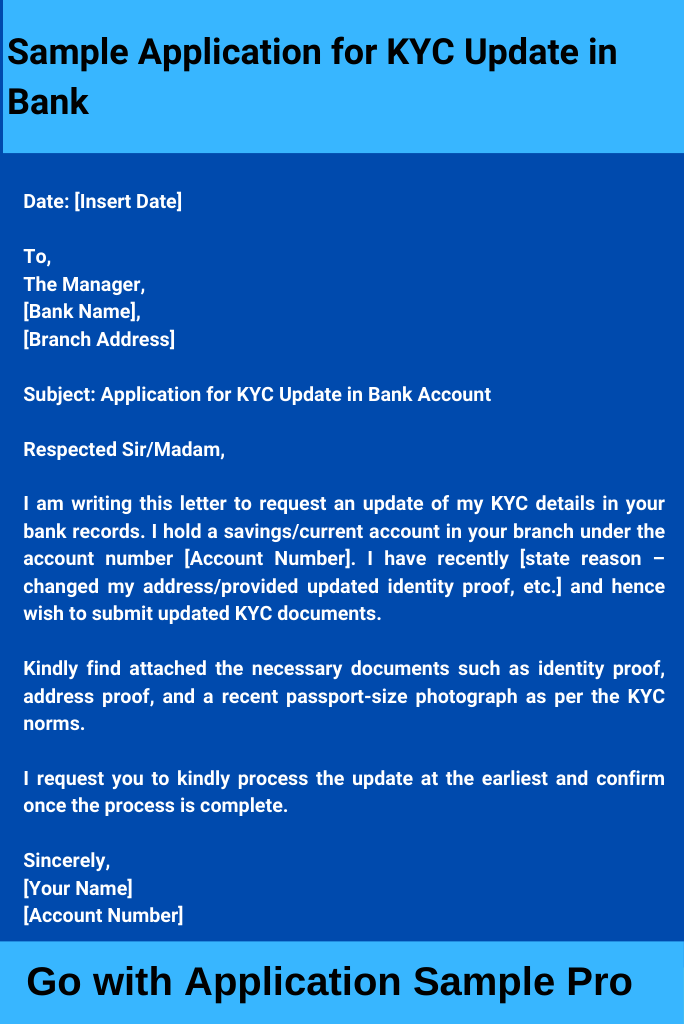

Sample Application for KYC Update in Bank

Date: [Insert Date]

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Application for KYC Update in Bank Account

Respected Sir/Madam,

I am writing this letter to request an update of my KYC details in your bank records. I hold a savings/current account in your branch under the account number [Account Number]. I have recently [state reason – changed my address/provided updated identity proof, etc.] and hence wish to submit updated KYC documents.

Kindly find attached the necessary documents such as identity proof, address proof, and a recent passport-size photograph as per the KYC norms.

I request you to kindly process the update at the earliest and confirm once the process is complete.

Sincerely,

[Your Name]

[Account Number]

What is KYC Update in Bank?

KYC (Know Your Customer) update in a bank refers to the process of refreshing and verifying a customer’s identification and address details at regular intervals or whenever changes occur. Banks require updated KYC to prevent fraudulent activities, comply with RBI guidelines, and offer seamless banking services.

Whether it’s due to a name change, address shift, expired documents, or periodic compliance, filing an application for KYC update in bank is a mandatory and straightforward process.

Application for KYC Update in Bank

If you are unsure how to write an application for KYC update in bank, keep your language polite, formal, and precise. Mention your account number, the reason for the update, and attach the necessary documents like:

- Aadhaar card

- PAN card

- Passport

- Voter ID

- Utility bill (for address proof)

- Recent photograph

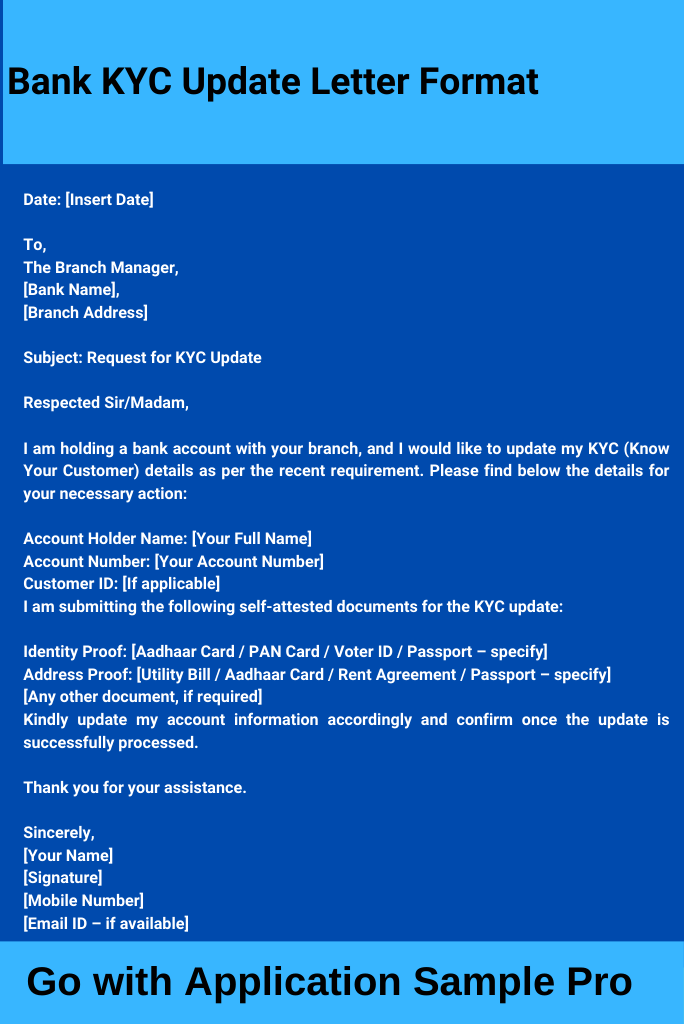

Bank KYC Update Letter Format

Date: [Insert Date]

To,

The Branch Manager,

[Bank Name],

[Branch Address]

Subject: Request for KYC Update

Respected Sir/Madam,

I am holding a bank account with your branch, and I would like to update my KYC (Know Your Customer) details as per the recent requirement. Please find below the details for your necessary action:

- Account Holder Name: [Your Full Name]

- Account Number: [Your Account Number]

- Customer ID: [If applicable]

I am submitting the following self-attested documents for the KYC update:

- Identity Proof: [Aadhaar Card / PAN Card / Voter ID / Passport – specify]

- Address Proof: [Utility Bill / Aadhaar Card / Rent Agreement / Passport – specify]

- [Any other document, if required]

Kindly update my account information accordingly and confirm once the update is successfully processed.

Thank you for your assistance.

Sincerely,

[Your Name]

[Signature]

[Mobile Number]

[Email ID – if available]

Here’s a simple bank KYC update letter format to follow:

- Date

- To (The Branch Manager)

- Subject line

- Your name and account number

- Reason for the update

- Mention attached documents

- Formal closing with your signature

Keep the tone respectful and straightforward.

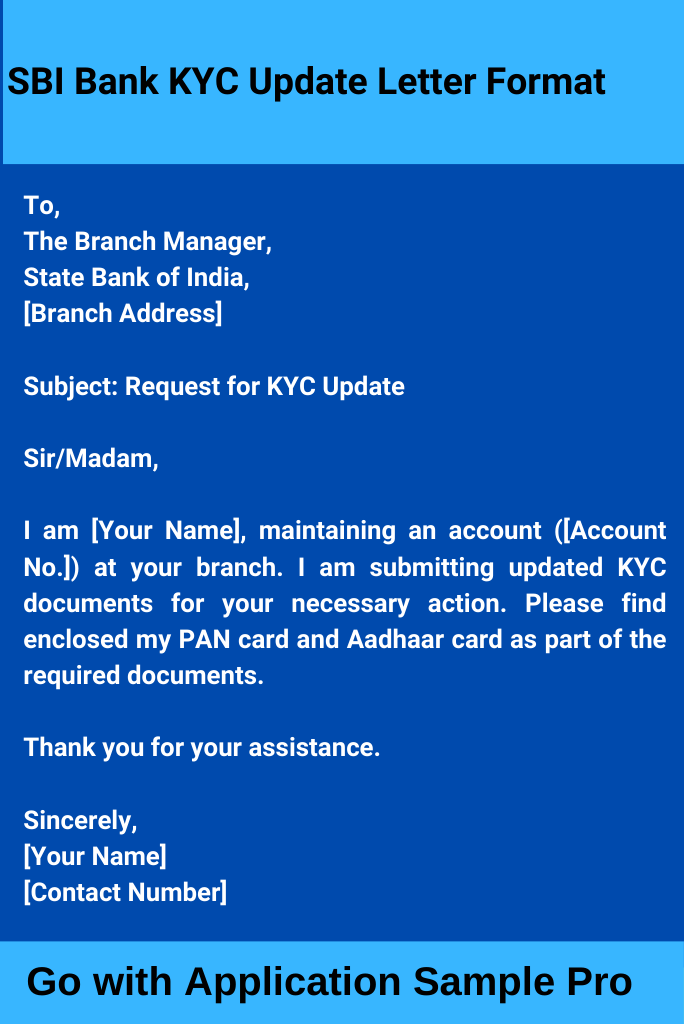

SBI Bank KYC Update Letter Format

SBI (State Bank of India) often requires customers to submit a written request for KYC updates. Here’s a brief format:

To,

The Branch Manager,

State Bank of India,

[Branch Address]

Subject: Request for KYC Update

Sir/Madam,

I am [Your Name], maintaining an account ([Account No.]) at your branch. I am submitting updated KYC documents for your necessary action. Please find enclosed my PAN card and Aadhaar card as part of the required documents.

Thank you for your assistance.

Sincerely,

[Your Name]

[Contact Number]

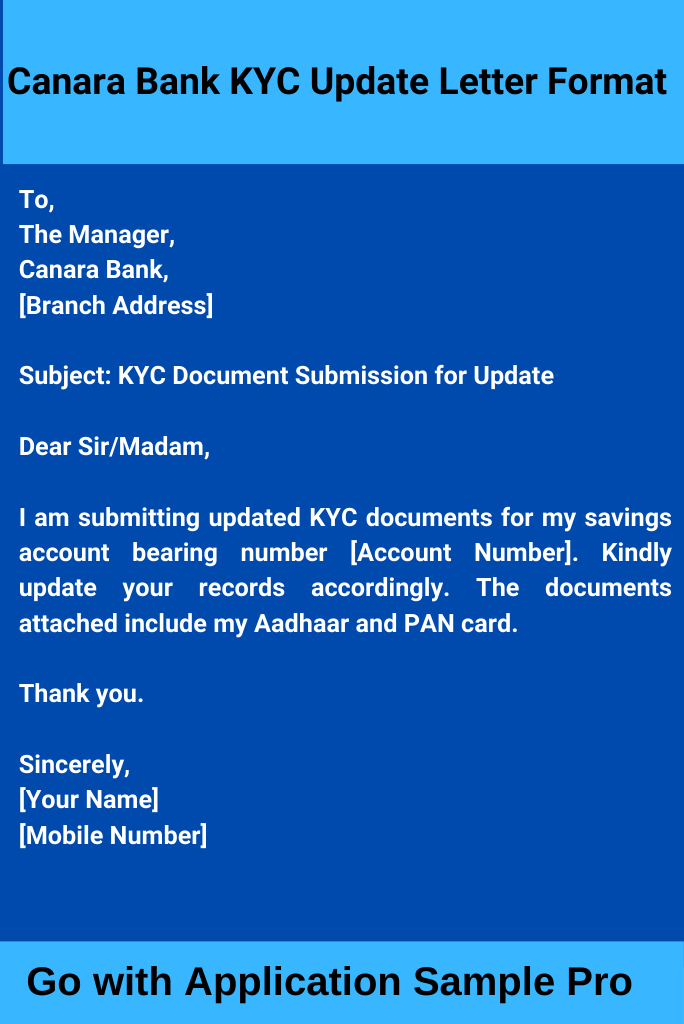

Canara Bank KYC Update Letter Format

For Canara Bank, your letter can follow a similar structure with a mention of your branch and updated documents:

To,

The Manager,

Canara Bank,

[Branch Address]

Subject: KYC Document Submission for Update

Dear Sir/Madam,

I am submitting updated KYC documents for my savings account bearing number [Account Number]. Kindly update your records accordingly. The documents attached include my Aadhaar and PAN card.

Thank you.

Sincerely,

[Your Name]

[Mobile Number]

Covering Letter Format for Bank KYC Update

A covering letter format for bank KYC update is often needed when you physically submit your KYC form. Keep it short and to the point:

I am enclosing my updated KYC documents along with this letter. Please find the attached copies of [mention documents] for your reference. I request you to update my bank records accordingly.

This letter is typically stapled with your photocopies for submission.

How to Write a Letter to Bank for KYC Update

Step-by-Step Guide:

- Start with the Date: Top left corner of your letter.

- Bank Details: Write the branch manager’s designation, bank name, and branch address.

- Subject Line: Clearly state the purpose — Request for KYC Update.

- Salutation: Use “Respected Sir/Madam”.

- Body of the Letter:

- Mention your name, account number, and customer ID.

- State the purpose: you want to update your KYC details.

- Mention the documents you are enclosing (self-attested copies).

- Closing Statement: Politely request them to process the update.

- Signature: Include your name, signature, contact details.

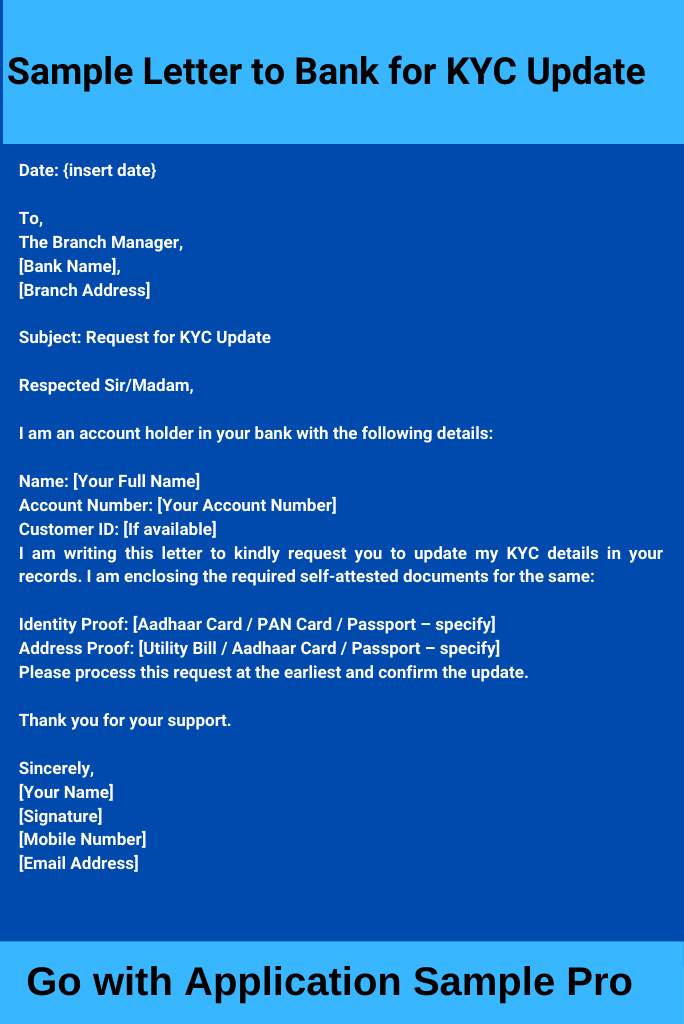

Sample Letter to Bank for KYC Update

Date: {insert date}

To,

The Branch Manager,

[Bank Name],

[Branch Address]

Subject: Request for KYC Update

Respected Sir/Madam,

I am an account holder in your bank with the following details:

- Name: [Your Full Name]

- Account Number: [Your Account Number]

- Customer ID: [If available]

I am writing this letter to kindly request you to update my KYC details in your records. I am enclosing the required self-attested documents for the same:

- Identity Proof: [Aadhaar Card / PAN Card / Passport – specify]

- Address Proof: [Utility Bill / Aadhaar Card / Passport – specify]

Please process this request at the earliest and confirm the update.

Thank you for your support.

Sincerely,

[Your Name]

[Signature]

[Mobile Number]

[Email Address]

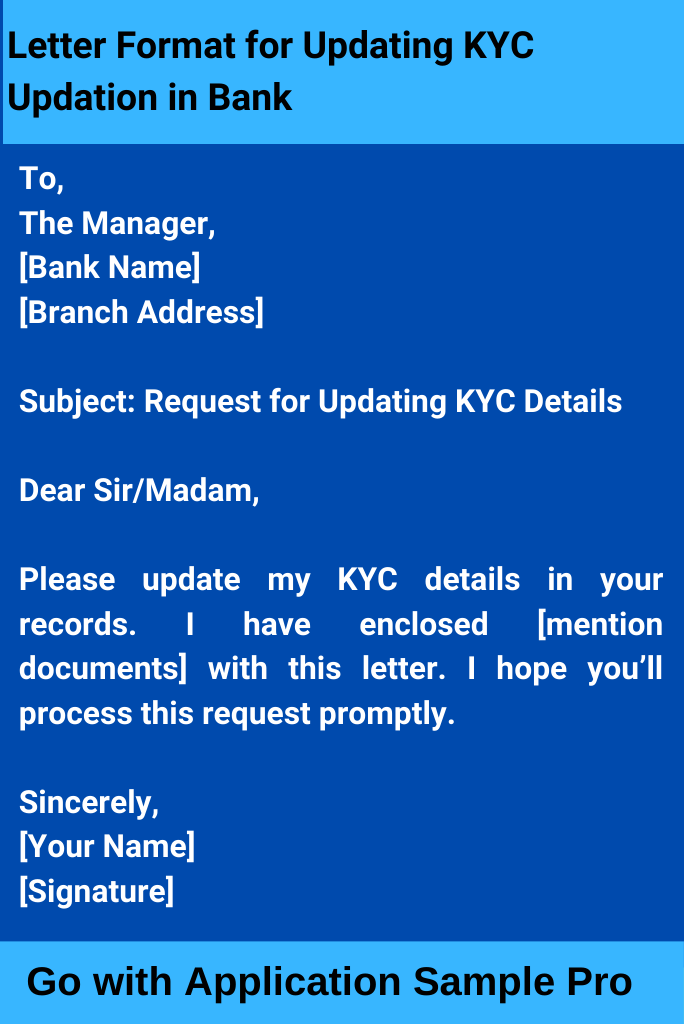

Letter Format for Updating KYC Updation in Bank

A formal letter format for updating KYC updation in bank must look something like this:

To,

The Manager,

[Bank Name]

[Branch Address]

Subject: Request for Updating KYC Details

Dear Sir/Madam,

Please update my KYC details in your records. I have enclosed [mention documents] with this letter. I hope you’ll process this request promptly.

Sincerely,

[Your Name]

[Signature]

FAQs about Application for KYC Update in Bank

What documents are required for KYC update?

You typically need one ID proof (like PAN) and one address proof (like Aadhaar, Passport), along with a passport-size photo.

How do I write an application for KYC update in bank?

Keep the letter formal, mention your account details, reason for update, and list of attached documents.

Can I submit KYC update online?

Yes, many banks allow online KYC updates through net banking or mobile apps, especially if only minor updates are needed.

Is there a deadline for KYC updation?

Banks usually notify you via SMS or email. It’s best to act within the mentioned timeframe to avoid account restrictions.

What is the KYC update process in SBI?

In SBI, you can either visit the branch with physical documents or submit via post/email (depending on the branch’s facility).

Conclusion

Updating your KYC with your bank is not just a regulatory requirement—it is essential for smooth financial operations. Whether you’re banking with SBI, Canara Bank, or any other institution, writing a correct and clear application for KYC update in bank helps maintain a seamless banking experience. Use the templates, formats, and tips provided above to avoid delays and keep your account in good standing.